Wealth Report Insights 2024 - Focus Paris

Junot Fine Properties presents the 18th edition of the Wealth Report, a reference study on trends, investments and choices of the planet's ultra-rich.

More and more UHNWIs*

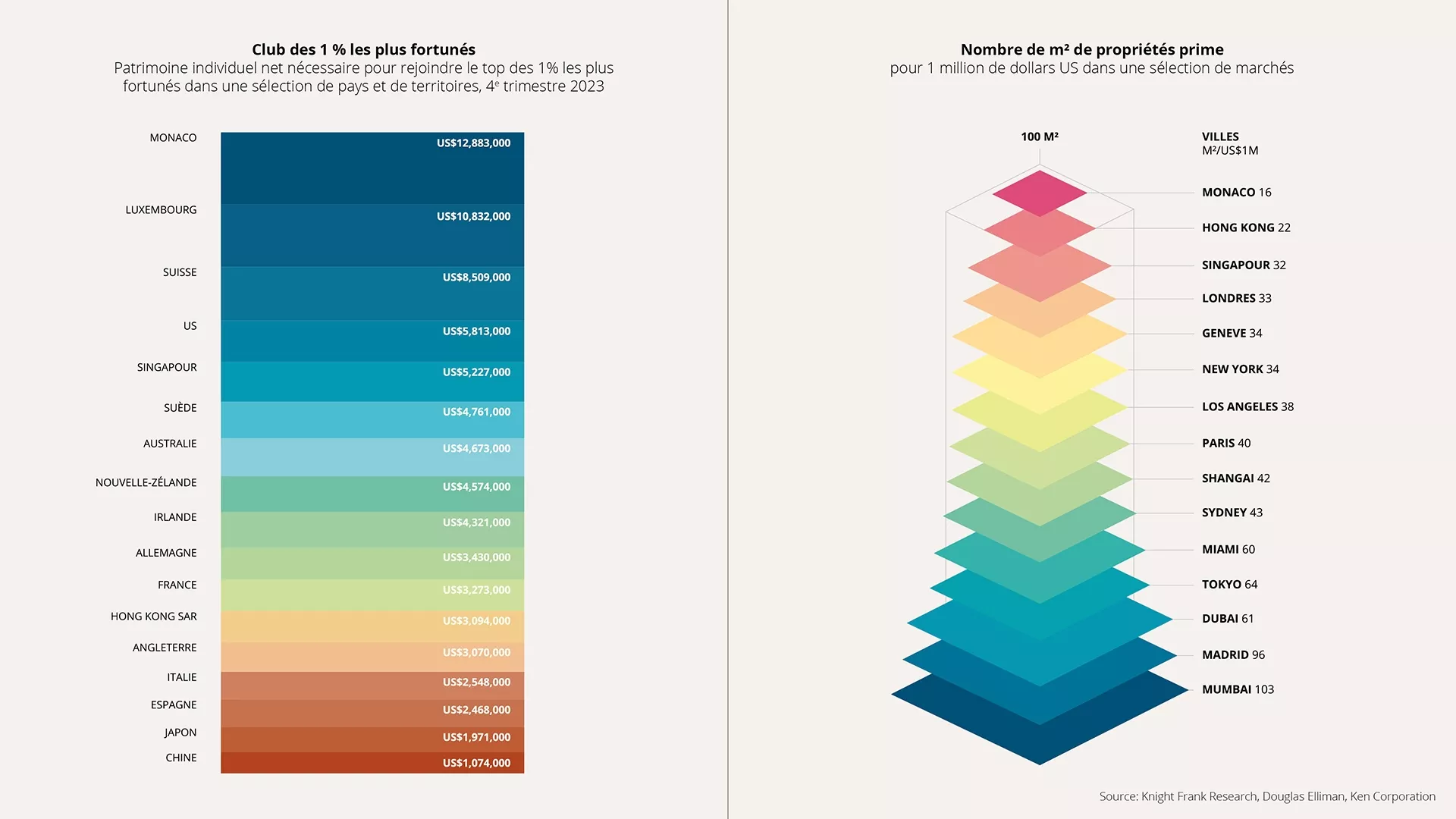

By the end of 2023, there were 4.2% more UHNWIs* than a year ago, with nearly 70 super-rich people being created every day, bringing the global total to just over 626,600. Growth was driven by North America (+7.2%) and the Middle East (+6.2%). While Europe remained at lagging behind in terms of new wealth creation, the continent continues to be home to the top 1% of the richest.

This supports our forecast that the number of ultra-high net worth individuals worldwide will grow by 28.1% over the five years to 2028. Our model indicates a strong outperformance from Asia, with strong growth in India (50%) and mainland China (47%) in particular.

Transfer to women and the new generations

Over the next 20 years, a transfer of wealth and assets will take place as the Silent Generation and Baby Boomers pass the baton to younger generations. On the other hand, Gen Z women’s attitudes toward wealth creation suggest that the 38% increase in UHNWI* women over the past decade is likely to continue. Recent findings from a survey conducted by Altrata reveal that women now represent approximately 11% of UHNWI* globally. While this is not yet a significant share, it represents rapid growth from 8% less than a decade ago.

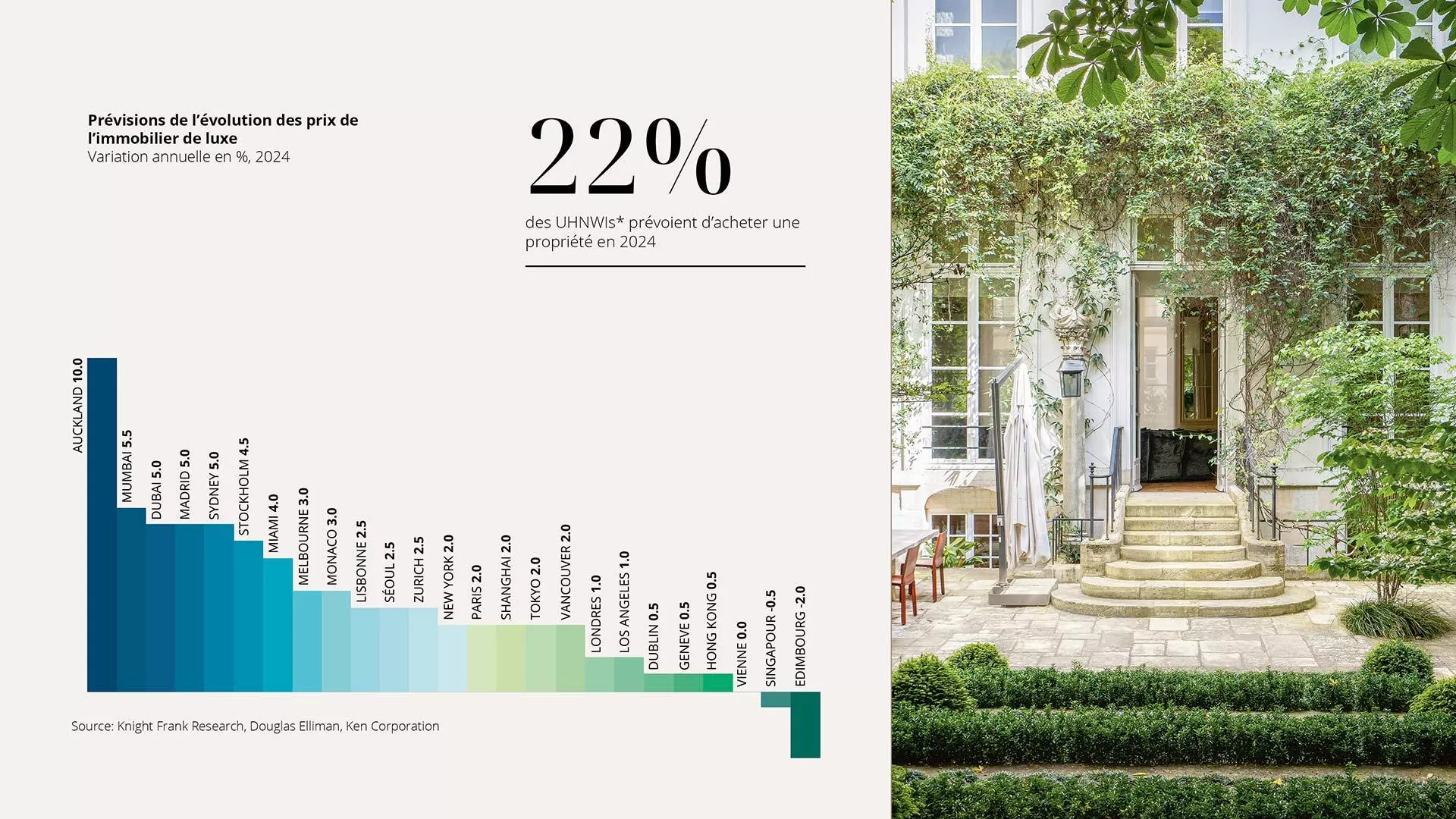

Luxury Real Estate Resistance despite the rise in rates

Luxury residential markets have held up well to successive interest rate hikes in 2023. The Prime International Residential Index (PIRI 100), which tracks luxury property prices in major residential markets around the world, reports positive annual growth of 2.5% for the Paris luxury residential market.

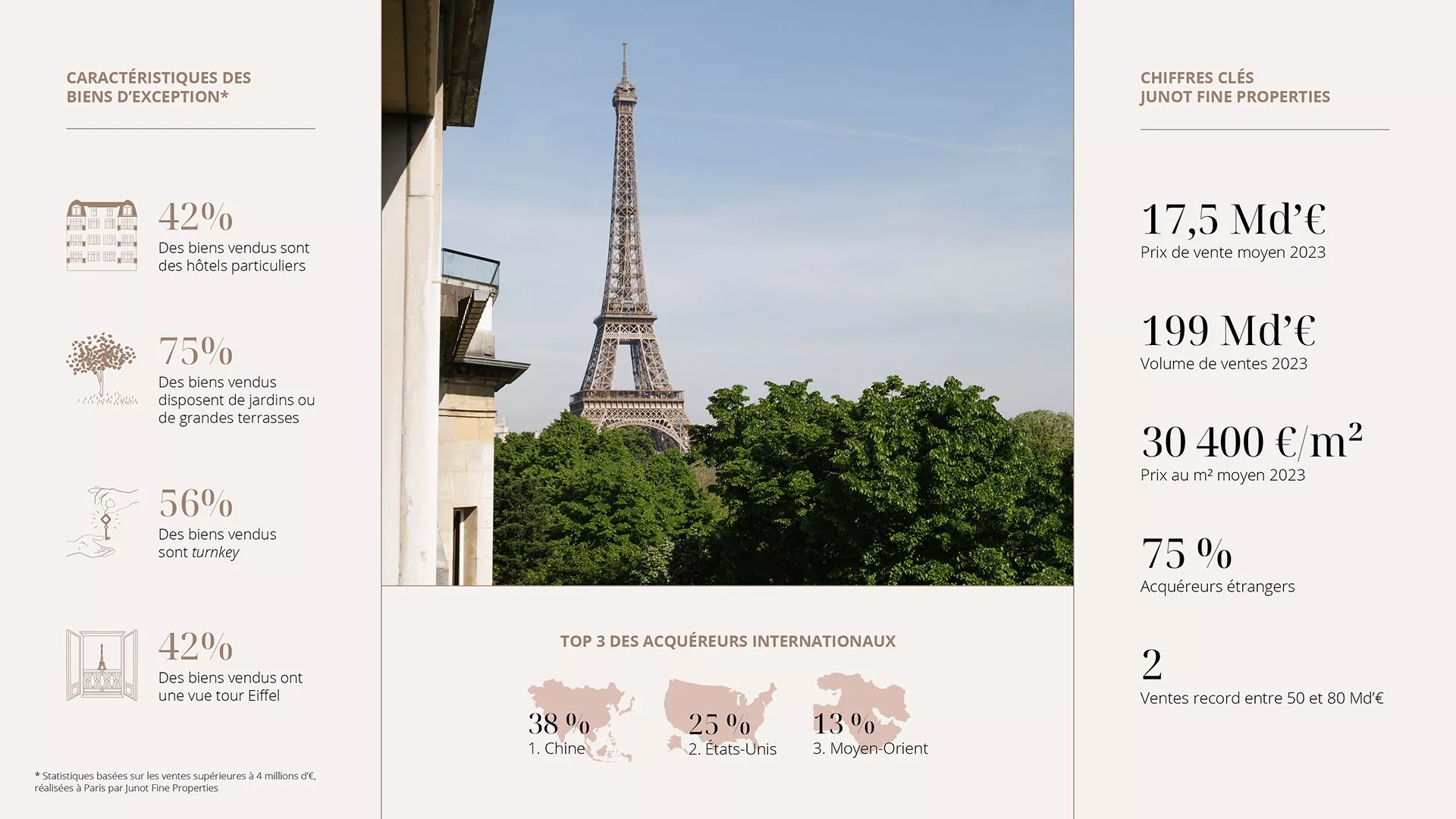

Junot Fine Properties I Knight Frank has made two record sales in Paris in 2023, between €50 million and €80 million, amounts rarely achieved before.

Strong attractiveness from France for capital

A series of business-friendly reforms has helped France attract more foreign direct investment than any other European country over the past four years, largely thanks to industry and innovation, but also to Paris’s thriving financial sector, according to EY. In 2022, Paris attracted 2,800 jobs from London’s financial services sector, compared with 1,800 to Frankfurt and 1,200 to Dublin, according to EY. Future measures could include adjustments to labor laws or initiatives to: facilitate the IPO of small and medium-sized enterprises.

Investment and new rules in energy efficiency

“Acquiring private rental stock in markets introducing new energy efficiency rules for landlords, such as Paris, would be my investment choice for 2024. Tenant demand continues to outstrip supply in most developed markets due to affordability constraints and demographics.

Some owners with several properties will relinquish their assets due to the cost of bringing many homes up to date with new energy efficiency rules. Properties that are not retrofitted will be banned from renting, although in most cases the rules will not apply to furnished holiday lets. »

Kate Everett-Allen, head of international and national research at Knight Frank.

Perspectives for 2024

More than a fifth of UHNWIs* plan to purchase residential property in 2024.

The types of properties and neighborhoods in Paris that will attract ultra-high-net-worth buyers in 2024:

“In 2024, architect-designed properties with custom-made furniture, but in a classic style, with views of the Seine or the Eiffel Tower, will be in high demand. This demand will be driven in particular by our Chinese and American clients, as Paris takes centre stage in the run-up to the 2024 Olympic Games.

Americans are still as fond of Paris with two requirements: the desire to have a turnkey Left Bank property, with original features and beautiful volumes, while offering the comfort to which they are accustomed. »

Alison Ashby, Director Junot Fine Properties.

* Ultra High Net Worth Individual (UHNWI): a person whose net worth exceeds $30 million.